Brooke Shields returns as the spokesperson for September’s Life Insurance Awareness Month (LIAM) to emphasize the value of life insurance.

Join Life Happens’ Twitter Chat for Life Insurance Awareness Month

Join Life Happens for a Twitter Chat to kick off Life Insurance Awareness Month (LIAM) this September. We’ll discuss new data that shows Americans are rethinking their finances and taking part in tough financial conversations in response to COVID-19.

Brooke Shields Has an Important Message for Life Insurance Awareness Month

Brooke Shields is an actress, model, fashion designer, wife and mom. And now she can add life insurance advocate to that impressive list. The multi-hyphenate is the 2020 national spokesperson for Life Insurance Awareness Month (LIAM), created and coordinated by Life Happens.

COVID-19 Is Prompting Families to Rethink Their Finances

COVID-19 has led families to cancel travel plans, get (semi!) comfortable with homeschooling kids...

Is Life Insurance Tomorrow’s Problem? Findings from the 2020 Insurance Barometer Study

For the last decade, Life Happens and LIMRA have come together to understand the “financial pulse”...

4 Steps You Can Take to Feel More in Control Now

COVID-19 has upended life as we know it for millions of people around the world. Many of...

Life (Insurance) in the Time of COVID-19

As the COVID-19 pandemic has spread, we’ve been bombarded with reminders of our own mortality. It...

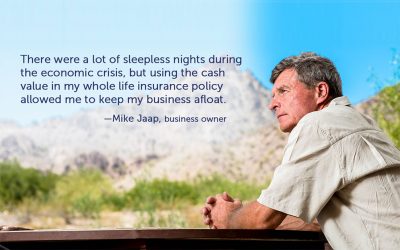

A Financial Lifeline You May Have Forgotten About

So much has happened in the last few days and weeks that I feel like months have passed. Social...

Join Our Special “Love Insurance” Twitter Chat During #InsureYourLove

Join us as we moderate a Twitter Chat during Insure Your Love Month along with NAIFA. We’ll...

5 Reasons Why Having Life Insurance Is Good for You

We get it: No one wants to think about death—for us or the ones we love. And a lot of people...

4 Tips for Applying for Life Insurance After a Breast Cancer Diagnosis

After feeling a lump in her breast earlier this year, my wife, Julie, who’s 35, had a 3-D...

Join Life Happens and NAIFA for a Special Chat During #LIAM19

Join Life Happens and NAIFA representatives on Thursday, September 26th from 1:00-2:00pm EDT as we...