On #GivingTuesday, we wanted to share a story that highlights how important your giving can be in...

4 Things Life Insurance Is Not

Are you confused about life insurance? I don’t blame you. When I first started writing about...

Here’s What People Are Worrying About (or not) When It Comes to Finances

Each year Life Happens and LIMRA join forces on the Insurance Barometer Study to get the latest...

Hey, Millennials. Life Insurance Is Now 80% Off!

So many people get down on Millennials, telling them they are doing just about everything wrong....

Danica Says It Best: Life Insurance Is Key on Your Financial Journey

It's Life Insurance Awareness Month! And we will just step aside to let our spokesperson Danica...

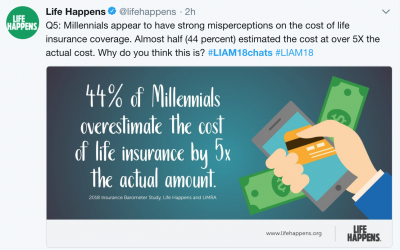

Join Life Happens and LIMRA for a Special Twitter Chat during #LIAM18

Join Life Happens and LIMRA representatives as we moderate a Twitter Chat focused on findings from...

5 Things to Know About Getting Life Insurance for Your Child

We spend so much time talking about the reasons adults need life insurance (income protection,...

5 Signs You Need to Up Your Life Insurance Coverage

Depending on the type of life insurance policy you have, you could be covered anywhere between one...

10 Things You Didn’t Know About Life Insurance

Life insurance blah blah blah. Is that what you hear when someone mentions it as part of your new...

Getting Married? Two Questions You Need to Ask Your Partner (but Probably Haven’t)

Getting married is a big leap. And you may be in the midst of a whole lot of planning—from when...

Wealthy vs Financial Fit. Here’s the Difference and Why It Matters

People can be wealthy without being financially fit, meaning they can have a lot of assets or...

Key Findings for the 2018 Insurance Barometer Study

Each year Life Happens and LIMRA join forces to get the latest and greatest information about what...