Why Life Insurance Should Be Part of Every Entrepreneur’s Business Plan

As an entrepreneur, you already know that many risks and uncertainties come with running a business. However, there is one crucial element that often goes overlooked in many entrepreneurs' business plans: life insurance. It may not be the most glamorous topic. Still,...

Featured

Why Life Insurance Should Be Part of Every Entrepreneur’s Business Plan

As an entrepreneur, you already know that many risks and uncertainties come with running a business. However, there is one crucial element that often goes overlooked in many entrepreneurs’ business plans: life insurance.

Recent Posts

Most people would say their family’s financial security is high on their list of priorities. And yet it’s hard to get excited about budgeting for life insurance.

A big part of that hurdle is cost — or, rather, perceived cost. The 2021 Insurance Barometer Study by ...

With 102 million adults living with an uninsured or underinsured need gap, there is a chance you need more life insurance coverage. Now is your opportunity to learn from financial experts and companies about the facts and benefits of life insurance during Life ...

Life insurance is there to pay for funeral and burial costs, right?

Yes! That’s correct. And many Americans understand that. In fact, it’s the No. 1 reason people state for having life insurance, according to the 2021 Insurance Barometer Study by Life Happens and ...

Many people know how term life insurance works. But they often don’t know how permanent insurance works.

To refresh, term life insurance provides protection for a specific period of time. This is known as the "term."

If you pass away during the term, your loved ...

If you’re LGBTQ, you may be fully exploring what it means to be able to build your life around who you love. Strong legal protections in the last 15 years have ushered in more than just external changes. According to MassMutual financial advisor Mindi Wernick with ...

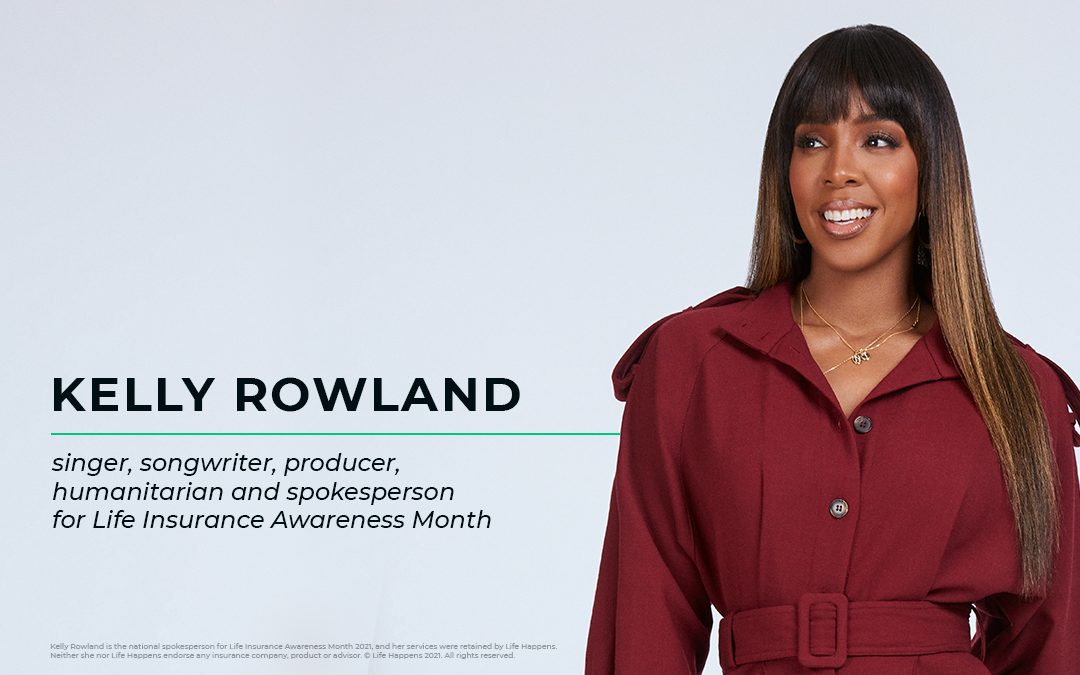

You may know Kelly Rowland as an award-winning singer, songwriter, producer and humanitarian. But she’s also a mom to two young boys, and this September, she’ll join us as the spokesperson for Life Insurance Awareness Month (LIAM), coordinated by Life Happens, to ...

More Posts

Each year Life Happens and LIMRA join forces to get the latest and greatest information about what consumers are thinking when it comes to their financial concerns as well as what insurance coverages they do or don’t have—and why! And that’s just the start.

The ...

A generation ago, unexpected loss of a loved one could be seen as an isolated situation. But today, a quick search of GoFundMe delivers a difficult reality check. Simply type “funerals” into the search field, and behold—799,182 results (on this particular day). ...

Fear of missing out—is more than just a hashtag. Many Millennials admit that #FOMO drives a lot of their decisions on what they wear, what they do, even what they eat and drink. We live in a world of social influence.

But one area where #FOMO really does you a ...

When I was 17, my father lost his battle with kidney and cardiovascular disease.

As long as I shall live, I do not believe that I will ever forget the first moment I saw my father’s once vibrant face in that cold and unforgiving casket. I won’t forget his lifeless ...

In this Instagram-able world, when it comes to attributes we look for in a romantic partner, we might think "looks" and "style" would come up at the very top of the list. Not so.

And that's good news, because besides sense of humor (which for most of us I think is ...

Join Life Happens as we moderate a Twitter Chat focused around romance, couples and finances during Insure Your Love Month.

We anticipate plenty of activity from consumers, the media, insurance companies, agents and advisors. We hope the chat helps promote how ...

Do I need life insurance once I retire?

Just because you’re retired doesn’t necessarily mean you’re financially sound.

Think of all the different scenarios that may still be applicable: You may have been required to retire early; you may have had investments that ...

Think you can’t qualify for life insurance? Think again.

You want to protect your loved ones for the future once you’re no longer around to provide for them. We all do. Life insurance gives you that peace of mind that your family will be taken care of after you’re ...

Only 52% of Millennials have life insurance, but a whole lot more than that have loved ones—spouse, partner, kids, aging parents—that need financial protection if something were to happen to them. Here's what the 2017 Insurance Barometer Study by Life Happens and ...

It’s Long-Term Care Insurance Awareness Month. Stop! Before you come to the rash conclusion that “It’s nursing home insurance for old people. I don’t need that!” please just spend two minutes with this video. (And know that 80% of people who need care get it in ...

If you’re one of the millions of Americans who owns a permanent life insurance policy (or are thinking about getting one!) you’ve probably done it primarily to protect your loved ones. But over time, many of your financial obligations may have ended. That’s when ...

We asked some top advisors what their advice is for being financially fit. Here’s what they shared with us. How many of these can you tick off?

It’s about the flow. Watch your cash flow and live within your means—that’s the starting point. Once that’s under ...