Americans can no longer make excuses for why they haven’t purchased life insurance. According to the 2021 Insurance Barometer Study, those who are uninsured appear to want more convenience in the life insurance process, citing that they haven’t been approached about it (46%), it isn’t offered through their employer (42%), and they haven’t gotten around to it (62%) as reasons they don’t have coverage.

Women and the Life Insurance Gender Gap

Women’s History Month is a time to reflect on women’s many contributions to American life. It’s...

5 Myths the Black Community Has About Life Insurance

Financial planner Delvin Joyce has worked hard to dispel myths that the Black community holds...

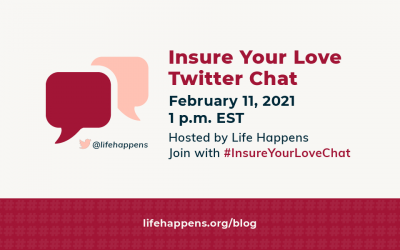

Join Life Happens’ Twitter Chat for Insure Your Love

Join Life Happens for a Twitter Chat during Insure Your Love month this February. We’ll discuss...

Why Single People Need Life Insurance

Many people wonder if single people need life insurance. It’s easy to believe the answer is “no.”...

8 Small Steps Toward Financial Protection

About half of all Americans make New Year’s resolutions. Along with exercising more and eating...

What to Know About Life Insurance for Diabetics

Many people falsely believe that life insurance for diabetics doesn’t exist. In reality, there are...

10 Advantages of Hybrid Life Insurance with Long-Term Care

You probably know about hybrid cars. But do you know about about hybrid life insurance? This...

Life Insurance From Your Employer Usually Isn’t Enough

Life insurance from your employer is a valued benefit for millions of American workers. Employer...

Remembering the Loeras During National Hispanic Heritage Month

Hispanics are the largest minority group in the United States. And their many contributions to...

3 Reasons to Give Life Insurance a Second Look

The COVID-19 pandemic has changed so much of our world, from day-to-day activities to long-range...

10 Ways to Make Affordable Life Insurance a Reality

Many people are looking to trim expenses during these uncertain times. Perhaps life insurance is...