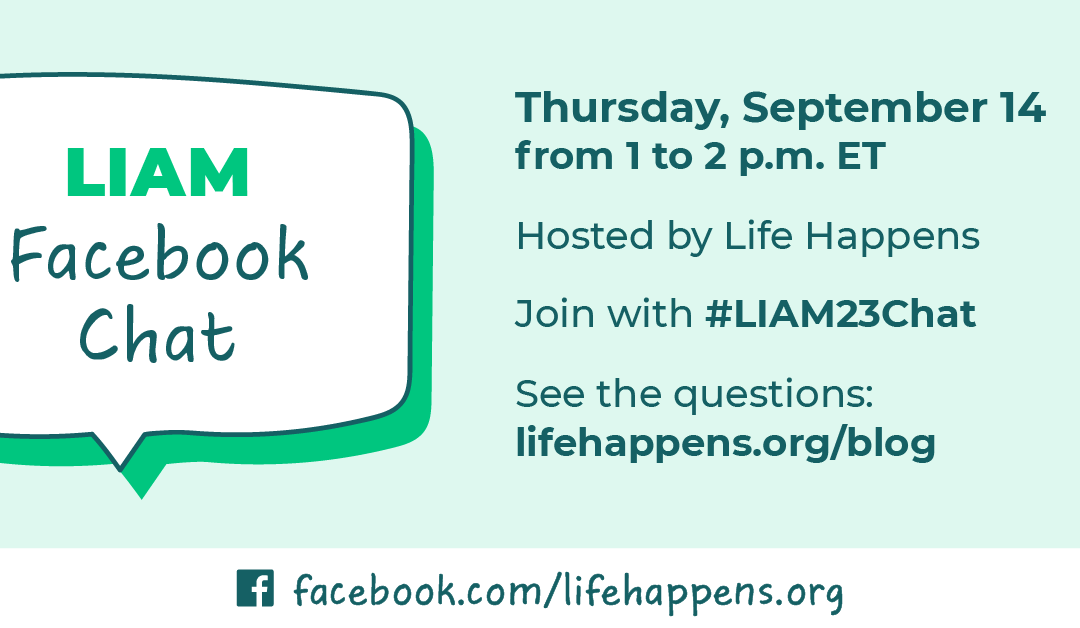

Participate in Life Happens’ Facebook Chat for Life Insurance Awareness Month

Join Life Happens for a Facebook Chat during Life Insurance Awareness Month this September. We’ll discuss all things life insurance and living benefits! Date: Thursday, September 14, from 1 to 2 p.m. ET Where: Join us on Facebook using your personal handle or your...

Featured

Participate in Life Happens’ Facebook Chat for Life Insurance Awareness Month

Join Life Happens for a Facebook Chat during Life Insurance Awareness Month this September. We’ll discuss all things life insurance and living benefits!

Recent Posts

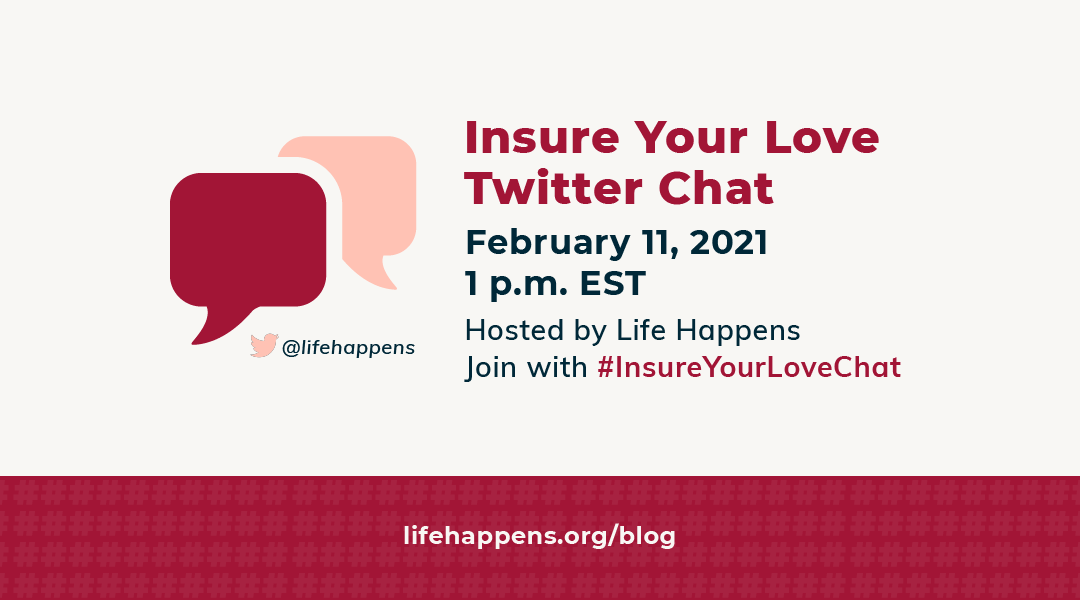

Join Life Happens for a Twitter Chat during Insure Your Love month this February. We’ll discuss new data that shows Americans are shifting their priorities and focusing on financial security in response to COVID-19.

The pandemic has helped many of us appreciate ...

Many people wonder if single people need life insurance.

It’s easy to believe the answer is “no.” After all, the main purpose of life insurance is to provide cash to your family if you were to pass away. So it seems logical to think you don’t need life insurance ...

About half of all Americans make New Year’s resolutions. Along with exercising more and eating better, many people aim to get a better handle on their finances.

If you’re in that camp, we’re here to help. Here are some surefire steps to create a more financially ...

Many people falsely believe that life insurance for diabetics doesn’t exist. In reality, there are quite a few life insurance options for the 34.2 million Americans who have diabetes.

While diabetes remains a health challenge for many, it is still very possible to ...

You probably know about hybrid cars. But do you know about about hybrid life insurance?

This coverage combines long-term care and life insurance into one policy. Like hybrid cars, these hybrid policies are increasingly popular. That's because they have some ...

Life insurance from your employer is a valued benefit for millions of American workers.

Employer life insurance is a form of group life insurance that’s offered to you and your coworkers. It’s typically a set dollar amount at smaller companies and a multiple of ...

More Posts

We spend a lot of time talking about how couples, families and businesses can protect their financial futures with life insurance. But what about if you are single—do you need life insurance, too?

There are those people who have no children, no one depending on ...

As a parent, perhaps you’ve been able to check the critical financial boxes for your family. You’ve established emergency funds, secured life and disability insurance, and are on track with your retirement goals. You may wonder, is there anything else I could be ...

Each year the government (the USDA to be exact) publishes how much it costs to raise a child to 18. The number is staggering. It's more money than most of us can imagine coming up with, which is why life insurance is so important. You can cover that ...

Let’s face it. Most people put off buying life insurance for any number of reasons—if they even understand it Take a look at this list—do any of them sound like you?

1. It’s too expensive. In the ever-burgeoning budget of a young family, things like day care and ...

Do you have your legal and financial documents stored (maybe stashed) in various places around your home? Some in a desk drawer? Others in your closet? Some in a safe? Even more in a file cabinet in the basement? It’s time to get a handle on all your documents and ...

My mother was so loving. She was also my best friend and my rock.

I had a great childhood. My mom was the educational director at the local nature center, and I spent a lot of time with her and all the great animals. And that included at home. We had a cat called ...

So you’ve made the decision to learn more about long-term care insurance. That’s smart, as neither health insurance nor Medicare would pay for extended long-term care services in the event that you needed them in the future. Plus, there’s about a 70% chance you’ll ...

When you’re just starting out, it often seems that a dollar never stretches far enough. And with new commitments, such as buying your first home or having children, comes the responsibility to make sure your loved ones will be provided for financially, no matter ...

You’ve picked out the rings, maybe even the venue … things are rolling toward your Big Day. But don’t forget an important element of your new life together: getting your financial lives in sync. Talking about finances with your fiancé or partner may not seem like ...

While Danica Patrick has had life insurance since the beginning of her career as a race car driver (for obvious reasons!), she's had a life-long understanding of its value. See why:

To learn more about if life insurance is something you need, start here.

With 1 in 5 adults using activity trackers, we were interested to see who was up for getting rewarded for their good fitness behavior. This infographic breaks down who would share their activity tracker information for better life insurance rates and other benefits.

‘‘Driving race cars for a living means going 200 miles an hour around a track with concrete walls. I know the risks, which is why I’ve had life insurance since the start of my career. But that’s not the only reason I own it," says Danica Patrick.

Watch this video ...