Life Insurance: Easing Financial Concerns for Single Moms

Whether or not we want to admit it, most of us have financial concerns. But what’s of particular interest: Almost a third of people (31%) say they are “very or extremely concerned” about a range of financial issues. The new 2023 Insurance Barometer Study by Life...

Featured

Life Insurance: Easing Financial Concerns for Single Moms

For single moms, 52% of those with life insurance feel financially secure vs. just 30% of those who don’t have it.

Recent Posts

Each year Life Happens and LIMRA join forces on the Insurance Barometer Study to get the latest and greatest information about what consumers are thinking when it comes to the financial concerns that are bothering them the most as well as what types of insurance ...

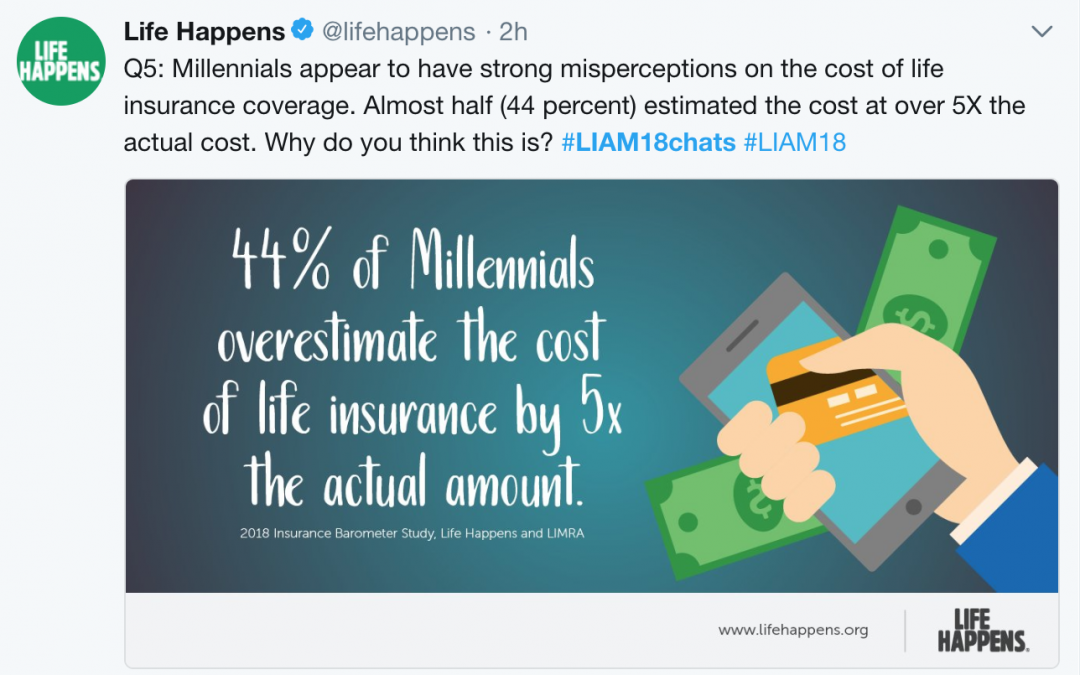

So many people get down on Millennials, telling them they are doing just about everything wrong. That's why when Life Happens and LIMRA did a joint Twitter chat for Life Insurance Awareness Month #LIAM18Chats, people had a lot of good insight and some great advice ...

It's Life Insurance Awareness Month! And we will just step aside to let our spokesperson Danica Patrick tell you why life insurance has always been important to her—and why it should be for you, too.If you think you may need life insurance, or more of it, spend a ...

Join Life Happens and LIMRA representatives as we moderate a Twitter Chat focused on findings from the 2018 Insurance Barometer Study. There will be plenty of activity from the media, insurance companies, agents and consumers. We hope the chat helps promote life ...

We spend so much time talking about the reasons adults need life insurance (income protection, covering funeral costs and so on) that it’s easy to forget why it may be a good idea for you to insure your children as well.

When we think about it, we reason that our ...

Depending on the type of life insurance policy you have, you could be covered anywhere between one year and the rest of your life, depending on if you have term or permanent life insurance. But if you’ve had a policy for a while, it might no longer be enough.

As ...

More Posts

No results found.